Ubank Debit card review: User of Ubank for many years, I have always been impressed by their best feature – high-interest rates for online savers. It was fine if I wanted to save cash somewhere, but found the app and digital experience a bit lacking for using it on a day-to-day basis.

However, in 2022, UBank merged with Neo Bank 86400 to bring together the best of each – a quality digital experience that offers great banking tools and products.

Since then I have increased my use of banks and find that they are quickly becoming a great alternative to the big banks and are constantly trying to upgrade and improve the way you bank on the phone.

This article will tell you what I found using the bank for my daily banking and what makes it strong now and who it would be best for.

Table of Contents

What is Ubank?

Ubank was developed by NAB in the early 2000s as a cheaper, faster, more digital-focused alternative to banking.

Ubank’s main advantage for customers was its highly competitive interest rates. Their home loan rates were very low, and their savings account rates were high. The problem I found as a customer was that the interface was a bit lacking and while the products (prices) were great, the experience was not.

All this changed in 2022 when uBank merged with startup Bank 86400.

By combining Eubank’s great rates and offers with 86400’s beautiful digital experience, we now have two of Australia’s strongest everyday banking offers.

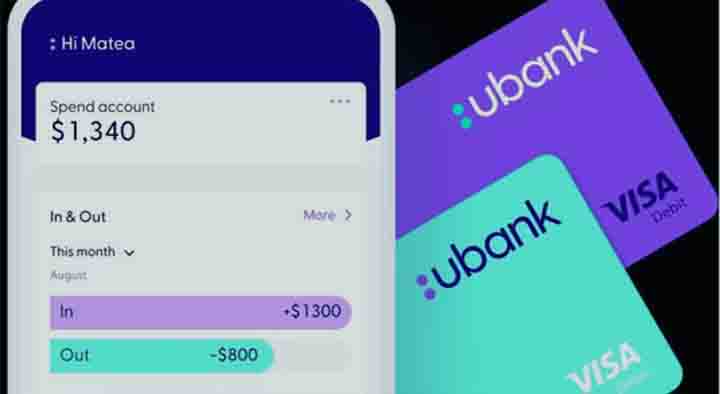

UBank is a banking experience built for your phone but comes with all the features you’d expect from a traditional bank. It is modern, attractive, and useful for those who need everyday banking.

Activating UBank Debit Card

Some of my friends are facing problems with this card abroad. Before you go on your vacation, make sure your card is active. You can use NAB ATM to turn your password into something more memorable. Once you do this do an EFTPOS transaction where you will need to enter your PIN. Your card should then be ready to go.

Ubank Travel Card: Access your money on the go

- Credit card with no FX fees (good for points and insurance)

- Debit card with no FX fees

- Cash exchange with family and friends

- Cash from ATM

- Replacing my audio at the first opportunity (this is an act of desperation)

It is important for me to have some local currency of the country, I need to find a smart ATM fast if I don’t bring it with me. There are many options available, the easiest is to get your home-bank ATM card What could be worse…

Benefits of The Ubank Debit Card

- It is backed by NAB, so the money is ‘safe as a bank’.

- There is no charge for

- ATM usage,

- FX conversion, or

- keep track of

It can be safer to separate your travel account and expenses from your ‘real’ bank account in case your card is lost or your card is hacked.

It can be helpful to set aside your savings and budget for your trip.

Disadvantages of Ubank Debit Card

At the time of writing, there is no access to the new payment platform (confusingly known as OSKO or PayID). Plan ahead and expect to wait a few days for the money to arrive on public holidays and weekends.

As it is online access only, you need to pass the ID online and wait for the card to be activated. Don’t bother going to the NAB branch like my friend Loveday; You won’t get any help.

The surprisingly frustrating and somewhat complicated “sweep” system can leave you short on cash without some planning.

Really bad details mean you have to dig around the site to find rates and amounts.

You May Also Like the following: