If you’re looking for a no-fee credit card with unique benefits and a full-featured app to help you manage your spending, our Brim Financial Mastercard review suggests this card is definitely worth considering. Why is this?

While the earning rates aren’t the most generous, Brim packs its no-fee MasterCard with features ranging from travel accident insurance to instant-approved installment plans.

With flexible redemption options and no annual fee, the Brim MasterCard is a leading contender for anyone looking for a free cash-back MasterCard.

Table of Contents

Brim Financial Mastercard Review

Comparisons like the one above underscore the importance of really knowing your priorities when you start your credit card search. What’s best for someone else may not be best for you, so it’s important to know what you want to do. To help with this, here are some questions to think about:

- Are you comfortable with a digital credit card company instead of an established bank?

- Do you value flexible point redemptions above all else, or would you prefer a higher earning rate with more limited redemptions?

- How important are gifts to you? Is there anyone, in particular, you want to see on your new card?

- Is travel insurance an important factor?

- Do you really need a no-fee card and are you willing to settle for lower-earning rates and fewer rewards?

Brim Financial Mastercard Benefits

While the Brim Financial Mastercard has no annual fee, it offers a variety of perks and perks that make it worth checking out.

- Earn 1% Cash Back: Cardholders earn 1 point per dollar spent on all purchases. This earning rate equals 1% cash back, 1 point = $0.01 There is no limit to how much cashback you can earn.

- In addition to flat-rate rewards offers, you earn points faster at hundreds of retailers through Incard, eShop, and Milestone bonus offers through the Brim Marketplace.

- In-Card offers are automatically applied when you pay using your Brim Card at selected stores The eShop offers are available on the Brim app and offer up to 30% off points.

- When you meet certain milestones, such as total spending or the number of purchases, you may also be eligible for bonus points.

What is Brim Financial?

Brim Financial is pushing the boundaries of traditional banking to better serve the needs of its customers. It is the first non-bank credit card issuer in Canada and is fully licensed by Mastercard.

It operates its own online shopping platform and offers an award-winning digital app for iOS and Android to help you track your finances. You’ll use the Brim app to manage your Brim credit card and redeem your points for rewards.

How does Brim Financial work?

Brim lets you earn points faster when you shop through the Brim eShop or online with a list of partners and up to 1 point per dollar you spend.

All you have to do is check the current offers that Brim advertises through its app. You may be able to earn additional points for shopping with select retailers based on limited spending or your shopping frequency or earn bonus points just for shopping with a merchant for the first time.

All you need to do is spend money on your card to start earning points. Each Brim point is worth 1 cent, so you need to spend $100 with a Brim Mastercard to earn $1 in rewards or cashback. That said, you can earn anywhere from 2 to 30 points per dollar spent with retailers that offer “boost” rewards to build up your points much faster.

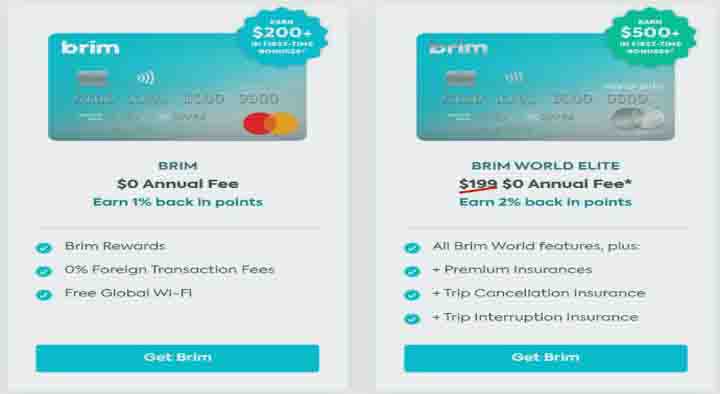

Brim Financial Mastercard At a Glance

- $0 annual fee

- Earn 1 point for every $1 spent

- Brim earns accelerated rewards rates at select retailers through Open Rewards

- 0% foreign transaction fee

- Free Global Wi-Fi via Boingo

- Access to a budget app

- Free supplementary card

- Mobile Equipment Insurance up to $500

- Common carrier accident insurance up to $100,000 per insured

- Event Ticket Protector Insurance

- Extended warranty and purchase protection

- Installment payment offer

How to Apply for Brim Financial Mastercard

- Personal Requirements: You can apply for this card if you are a Canadian resident who has reached the age of majority in your province/residence.

- Minimum Income Requirement: None

- Approximate Credit Score Requirements: 725-759 (Very Good)

FAQs: Brim World Elite Mastercard

Brim Financial, a partner of Canadian Western Bank, will launch a fintech platform, a consumer credit card. Brim has partnered with Canadian Western Bank (CWB) to give CWB customers access to Brim’s “Platform-as-a-Service” technology.

If you are a Brim World Choose Mastercard if you have an annual income of at least $60,000 or a household income of at least $100,000, or if you choose the Brim World Elite MasterCard, if you have an annual income of at least $80,000 or a household income of at least $150,000

Here are some of the key security features available on Brim Mastercards: the ability to not only lock your car instantly, but only for online or foreign currency purchases, setting spending limits on authorized users, and more. Get instant purchase notifications.

Brim Financial is a Canadian fintech company and the only fintech company in Canada licensed to issue credit cards. They launched their own MasterCard suite in July 2018, and the points you earn can be redeemed for merchandise on their online shopping portal or as cash back on your statement.

The bottom line

The Brim Financial Mastercard allows you to earn points for in-store or online purchases through the Brim eShop. You can access over 250 offers through Brim’s online app and earn up to 1 point per dollar at select retailers.

Brim Mastercard comes with many benefits including free Wi-Fi, no foreign transaction fees, zero-interest financing, mobile device protection, common carrier insurance, and online budgeting tools.

You May Also Like the following: