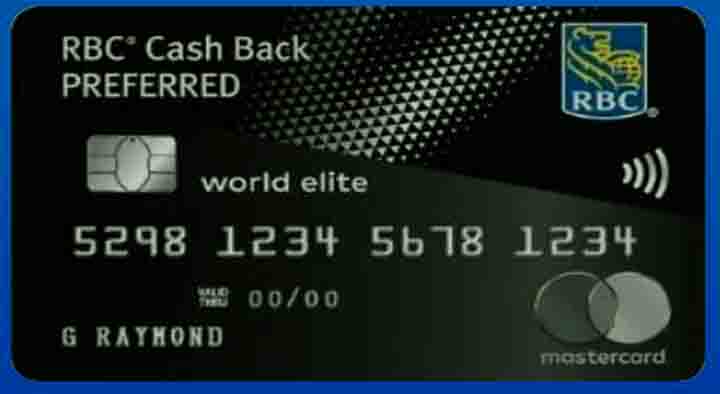

The RBC Cash Back Preferred World Elite MasterCard is one of the easiest ways to earn cash back on all your purchases – big or small. Earn unlimited 1.5% cashback on all eligible purchases If you don’t want to worry about what to buy to maximize your cash back rewards, this RBC card can be a good option.

Table of Contents

RBC Cash Back Preferred World Elite Mastercard Overview

- Annual fee: $99

- Reward: 1.5% Unlimited Cash Back

- Interest rate: 19.99% for purchases and 22.99% for cash advances (21.99% in Quebec)

- Recommended Credit Score: 600 – 900

- Minimum income required: $80,000 personal income or $150,000 family income.

- Get 1.5% unlimited cashback on all purchases

- Save 3¢ per liter of fuel at Petro-Canada.

- Access to over 1 million Bingo Wi-Fi hotspots worldwide.

- Earn extra Be Well points at Rexall.

- Free shipping on DoorDash for 12 months.

- MasterCard Travel Rewards.

- Access to over 1,300 airport lounges with the MasterCard Airport Experience.

- Auto rental includes collision/damage damage insurance coverage.

- Optional extras are available including travel insurance coverage and RBC Road Assist.

- Additional cards are free.

RBC cash back preferred world elite mastercard benefits

With this card, you can earn unlimited cashback @ 1.5% on all your spends. Rewards accumulate automatically, making it easier to track your rewards

- Shop at Rexall and earn extra Be Well Points. Earn 50 points for every $1 spent, to get 25,000 B Well points worth $10.

- Enjoy MasterCard membership services and on-demand apps with exclusive offers and benefits.

- Enjoy MasterCard travel rewards and cash back offers at international restaurants and retailers.

- Purchase protection and extended warranty insurance included.

- You can add a number of optional extras including travel insurance, RBC Road Assist, Balance Protector Max insurance, and ID theft and credit protection.

- With the MasterCard Airport Experience powered by DragonPass, you can access more than 1,300 airport lounges and enjoy airport spa and dining offerings.

- RBC Offers offers personalized offers where you can enjoy cash savings and bonus points.

- Car rental collision/damage damage insurance is included with the card.

- Save on DoorDash delivery fees by getting $0 fees for 12 months on orders of $15 or more. Plus, add your card to your DoorDash account and get a free 12-month membership worth $120.

- Use Credit Card Lock to temporarily lock your card if it’s lost. Simply go to the app to activate the lock.

- Supplementary cards are free.

- Get a complimentary Bingo Wi-Fi account and connect to over 1 million hotspots worldwide

- Save on your Petro-Canada purchases. Link your card and save 3 cents per litre. You earn 20% more Petro-Points when you use Petro-Canada.

Eligibility Requirements

You must be the age of majority in your province and a resident of Canada to qualify for the card. You must have good credit (score above 670) and you have not declared bankruptcy in the last 7 years.

Most importantly, you must have a minimum personal income of $80,000 or a minimum family income of $150,000. If you meet all these requirements, you are ready to apply for the card.

How to Apply for the RBC Cash Back Preferred World Elite Mastercard

First, find out if you qualify for this credit card. Although it is not specifically stated, you need a good credit score. If your score is fair or poor, you may want to look for a secured credit card instead.

Make sure you meet the minimum income requirement of $80,000 personal income or $150,000 family income. You must also be of the age of majority in your province or territory and a resident of Canada.

If you meet the requirements, you can apply directly through the website using the ‘Apply Now’ button.

Just provide all the required information, and RBC claims you’ll get a response within 60 seconds.

Is the RBC Cash Back Preferred World Elite Mastercard Worth It?

If you’re looking for a premium cash back card, the RBC Cash Back Preferred World Elite MasterCard is a great option.

Although you have to pay a reasonably high annual fee and have a high minimum income requirement, it packs in enough benefits to make it worthwhile.

The 1.5% unlimited cash back is great, although it would be nice to have the chance to earn higher amounts on certain spending categories.

Additional savings and offers are also in effect at Petro-Canada, Rexall, DoorDash and more.

How to Redeem Cash Back

Redeeming cashback on the RBC Cash Back Preferred World Elite MasterCard is as automatic and stress-free as earning cashback on this card.

Do nothing and the cash back will be automatically redeemed at the end of each year and your January statement as a creditwill be applied to You can request to redeem cashback anytime during the year if your cash back balance is $25.00 or more.

Be aware, once you request to redeem cash back your total available cash back will be redeemed automatically and cannot be redeemed incrementally at your discretion. However, many other cash back cards only allow you to redeem cash back

Manually, so being able to redeem whenever you want is a huge plus.

FAQ:

The WestJet RBC World Elite MasterCard is an excellent card for frequent WestJet travelers. The welcome bonus is impressive, and you only need to make one purchase to get it. Additional perks including earning rates and free checked bags will also come into play.

National Bank’s MasterCard, World Elite Credit Card, won the Milesopedia 2022 awards for Canada’s Best Credit Card for Travel Insurance, Best MasterCard Credit Card with Flexible Rewards and Best Premium MasterCard Credit Card.

Purchases: 19.99% Cash Advances: 22.99% (21.99% if you live in Quebec) These interest rates are effective from the date you open your credit card account (whether your card is active or not).

Note: This card requires a minimum personal income of $150,000 or a minimum family income of $150,000 for this card.

It is a high-quality global bank that has generated long-term total returns for investors. The new acquisitions should help boost profits over the next few years, and steady dividend growth in the 7-10% range is expected.

The bottom line

The RBC Cash Back Preferred World Elite Mastercard has a high barrier to entry. If you meet the minimum income requirements, you can get a cash back rate on any type of purchase using this card. Get up to 1.5% cashback on all eligible purchases

You May Also Like the following: